car sales tax illinois vs wisconsin

Use this tool to compare the state income taxes in Wisconsin and Illinois or any other pair of states. This tool compares the tax brackets for single individuals in each state.

Sales Taxes In The United States Wikipedia

More about the Illinois Income Tax.

. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Some dealerships also have the option to. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Form ST-556 Sales Tax Transaction Return. 775 for vehicle over. Just curious if I have to pay Wisconsin sales tax on the car buying at a dealer and Illinois sales tax.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return. When Chicago has everything you need as a young professional we forget about Illinois neighbor to the north. For example sales tax in Naperville is 775 and 875 in Joliet.

More about the Wisconsin Income Tax. Side-by-side comparison between Illinois and Wisconsin using the main population demographic and social indicators from the United States Census Bureau. In addition to state and county tax the City of.

Additionally sales tax varies from city to city in Illinois. By Travis Thornton May 31 2022. Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency.

Calculate Car Sales Tax in Illinois Example. If you try to register the car in Illinois youll have to pay use tax at the time of registration on the difference between the sales tax paid to the state where you purchased and. Is it better to live in Illinois or Wisconsin.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle. Is it better to live in. Just curious if I have to pay Wisconsin sales tax on the car buying at a dealer and.

Whether the car is purchased used or new. 635 for vehicle 50k or less. The total tax rate also depends on your county and local taxes which.

However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against. There is also between a 025 and 075 when it comes to county tax. There are also county taxes of up to 05 and a stadium tax of up to 01.

Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. In Wisconsin the state sales tax rate of 5 applies to all car sales.

2022 State Tax Reform State Tax Relief Rebate Checks

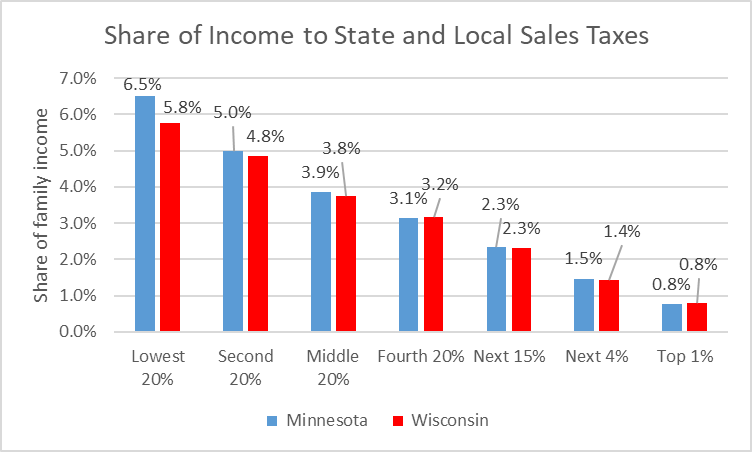

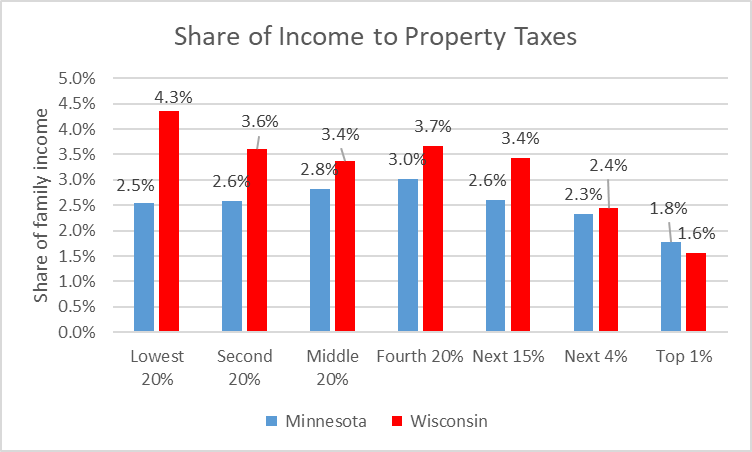

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

Illinois Used Car Taxes And Fees

Car Tax By State Usa Manual Car Sales Tax Calculator

State Income Tax Rates Highest Lowest 2021 Changes

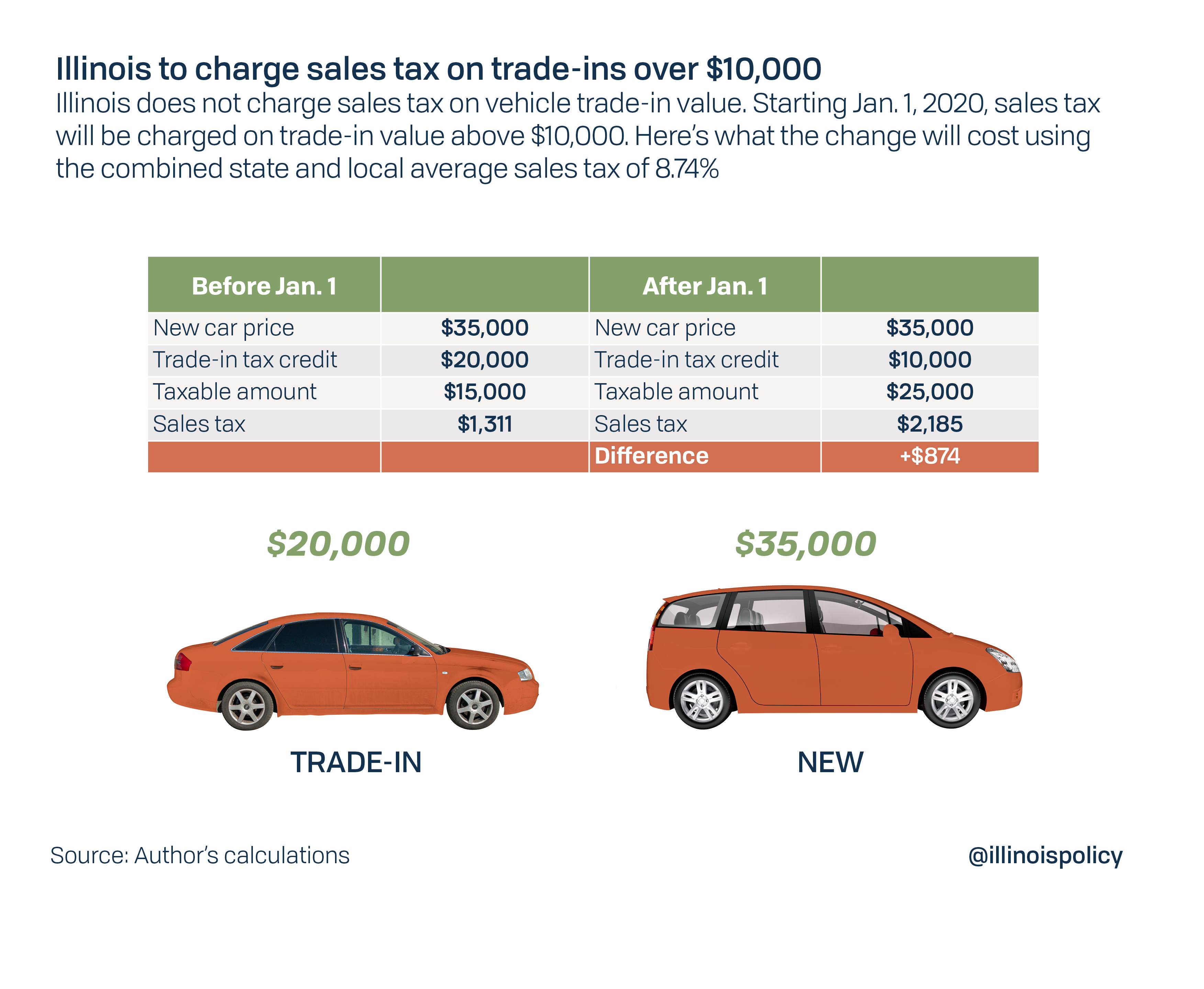

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

What S The Car Sales Tax In Each State Find The Best Car Price

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

A State By State Analysis Of Service Taxability

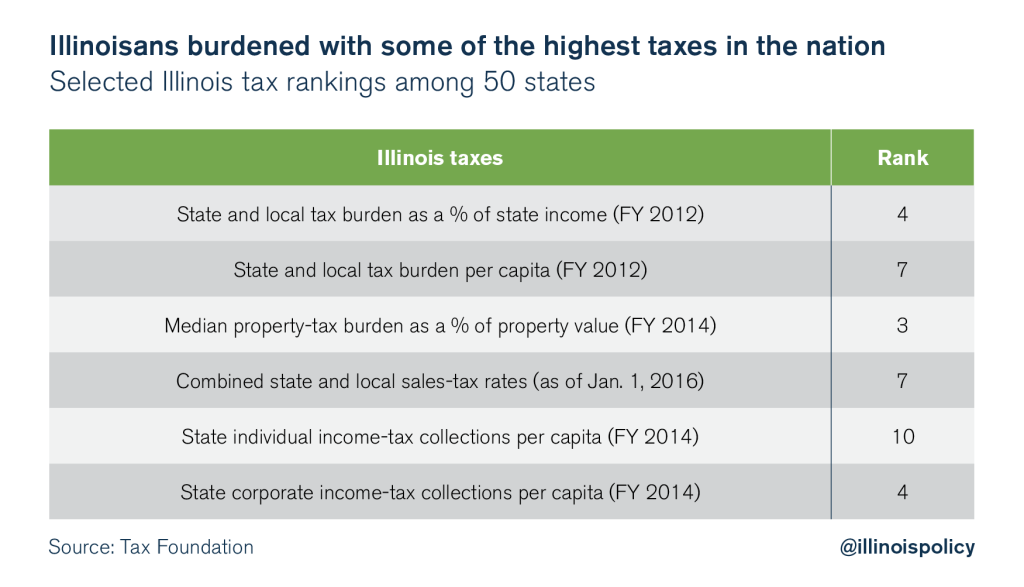

Illinois Is A High Tax State Illinois Policy

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

What S The Car Sales Tax In Each State Find The Best Car Price

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

This Is The Average Price Of A Used Car In Each State Ktla

Used 2013 Nissan Sentra For Sale In Escondido Ca With Photos Cargurus

If I Buy A Car In Another State Where Do I Pay Sales Tax

Are There Any States With No Property Tax In 2022 Free Investor Guide